Fund Businesses, Strengthen Communities

By offering private lending to people and businesses, when traditional lending sources fail to provide funding, business opportunities are created. These funding opportunities improve business outcomes, which also lead to job creation. As a result, private money lenders play a considerable role in positive life-changing events for community members.

When people and businesses are faced with severe financial challenges from a highly bureaucratic lending environment and hear the word “no” from institutional lenders, borrowers turn to a growing number of private funding sources for help.

Private funding sources, called Private Money Lenders, can often fulfill business funding needs on more flexible terms than traditional loan institutions, which must adhere to strict lending requirements and very lengthy loan processes.

Many lending institutions, banks, and hard money lenders (alternative lenders) rarely offer real estate loans of less than $75,000, especially if the property needs to be rehabbed.

Those banks and hard money lenders often fail to consider the borrower’s complete financial situation and neglect to consider what the borrower may have to offer (collateral) to ensure a secured lending opportunity. This under served lending niche represents the majority of real estate investors. Because so many real estate investor needs can’t be met through typical lending avenues, your community is likely filled with borrowers who require private funding.

As with most American private money lenders, real estate investors use our funding for purchases and rehabbing, and to refinance existing properties, such as improving housing conditions in communities. However, while most private money lenders only lend to real estate investors, we have also had excellent success funding and partnering with business start-ups, business expansion, and business rescue.

By providing private funding to people and businesses in our communities, private money lenders have created significant financial wealth for themselves. The private money lenders achieve financial wealth by generating an above-average market annualized rate of returns, compounding profits, and additional monthly cash flow.

Many times, private money lenders partner with others in businesses. These cases lead to profit sharing and/or opportunities to purchase businesses and real estate at deeply discounted rates.

This unique relationship between borrowers and lenders benefits so many, the borrower, the lender, and the community. A win-win situation for all parties.

Have questions? Find your answers here!

Introduction to Private Money Lending

While most private money lenders solely work with real estate investors, our private money lending has also successfully funded numerous business endeavors, such as business startups, expansions, and rescues. By funding both real estate and business transactions, a private money lender can generate a rate of return (ROI) of up to 35% annually, if not more, and often leads to additional financially rewarding business opportunities.

In this book, and with our educational training course, you will learn from experts with over thirty years of private money lending experience. Here, you will learn how to become a successful private money lender, and you will have opportunities to help people and businesses in the community where you live and serve.

Private money lending isn’t just for millionaires or those with a lot of cash on hand. That’s only a myth. You can easily get started with between $5,000 and $10,000 to fund your first transaction. Billions of dollars are successfully loaned each year by private money lenders, filling a gap where banks, hard money lenders, and other institutional lenders don’t always fund.

Lastly, the key to successful private money lending is about learning how to mitigate risk. Many other investment and business opportunities can be quite risky, and you rarely have the opportunity to reduce risk when involved with purchasing stock or running a business.

This book will focus primarily on using real estate as collateral to mitigate risk. However, when looking at collateral (security for a loan), one might also consider automobiles, boats, or other business assets such as inventory and accounts receivable (proceeds from sales), etc.

Attaining collateral as security for a loan requires “a legal claim on assets that allows the [lender] to obtain access to the [collateral] property if the debts are not paid.” This legal action is called a mortgage or lien (Investopedia.com). Essentially, a private money lender ACTS AS THE BANK, where the risk is secured by a first lien, meaning you generally get paid first in the event of liquidation.

As a successful private money lender, you will learn how to manage risk, and in the future, with successful lending relationships, your fears of financial risk will significantly diminish.

Those fears will be replaced with a desire to fund more transactions. Profits are tremendous. Risks are low, and there are plenty of requests for business-purpose loans with collateral.

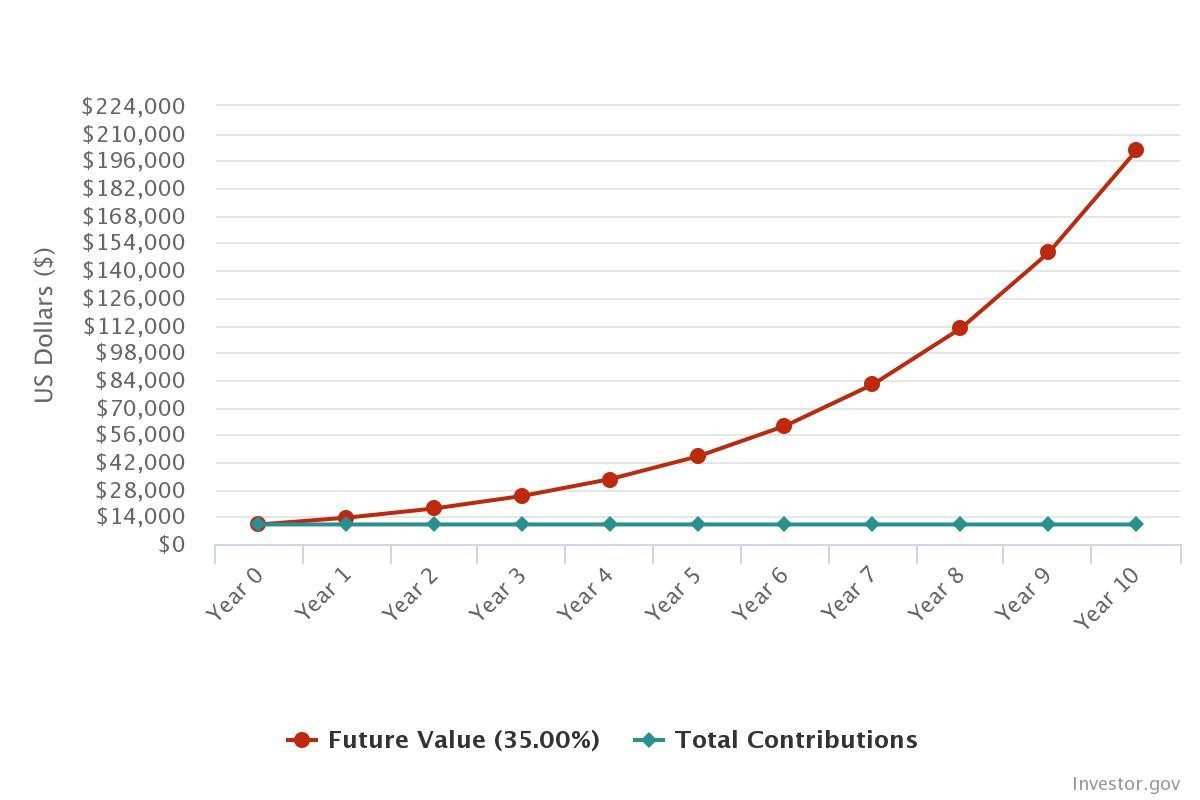

From $10,000 to $201,066 in ten years!

Figure 1

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Consider these possibilities. Suppose you start your private money lending business with an initial investment of $10,000 and earn a 35% annual return on investment (ROI) while continuing to invest your principal and profits. In that case, your compounded investment could increase to $201,065.56 after ten years! (see figure 1)

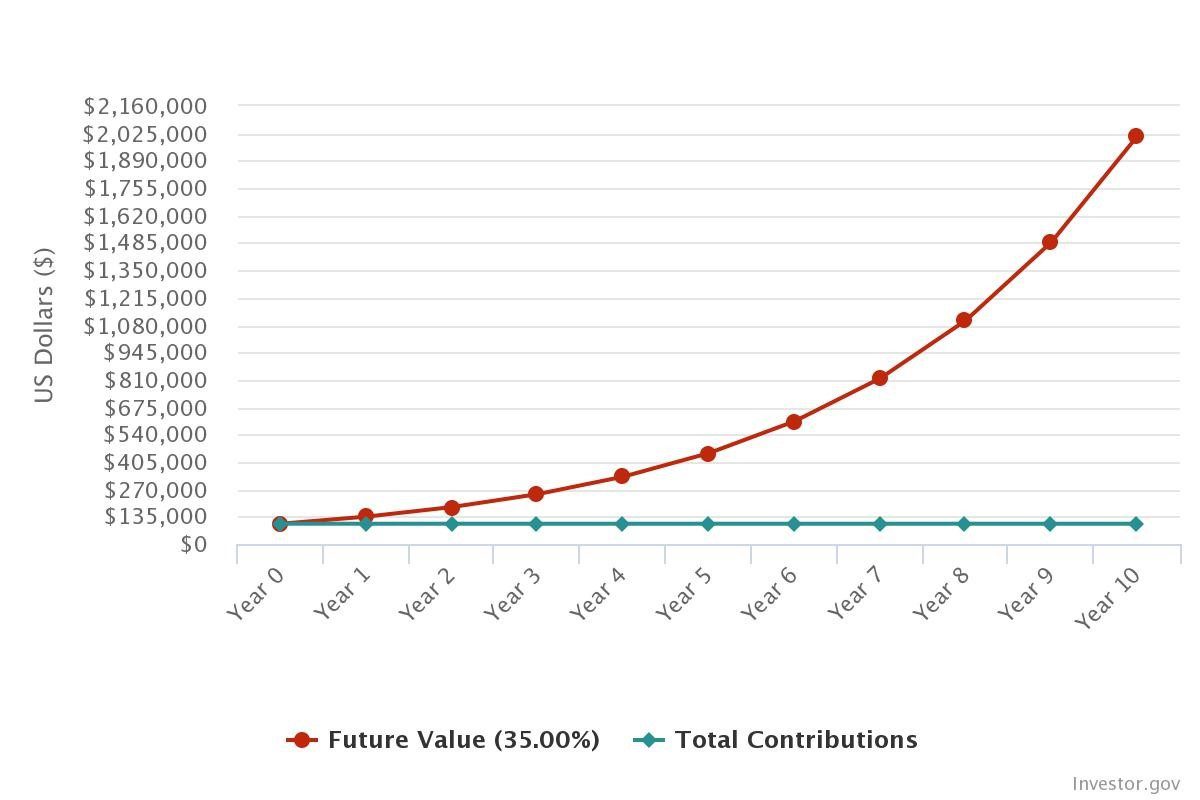

From $100,000 to over $2million in ten years!

Figure 2

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Think about this. If you start your private money lending business with an initial investment of $100,000 and earn a 35% annual return on investment (ROI) while continuing to reinvest your principal and profits, your compounded investment can increase to $2,010,655.59 after ten years! (see figure 2)

What Do We Do and Why Is It Needed?

Real estate investors and business owners often need immediate, temporary, short-term loans. While loan needs vary, these short-term loans that private money lenders provide are referred to as bridge loans. Bridge loans help support the borrower’s business needs until long-term funding is secured, often by a traditional lender (bank), hard money lender, sale, or otherwise. Some of these most common short-term funding needs include purchasing real estate, rehab funding, paying real estate taxes, refinancing, business start-ups, business expansion, and business rescue. A typical borrower who needs a bridge loan is most often able to repay the loan in approximately four to six months but could need up to one year to repay.

Without a bank alternative such as private funding, there could be a significant negative financial impact on the economy, businesses, and the real estate industry. All may suffer the loss of future opportunities or ongoing revenue.

Real estate investors have common requests. To get the best-discounted price on a real estate purchase from a seller, real estate investors often require immediate cash to structure their purchase offer and need to close the purchase transaction expeditiously (typically within two weeks). Having cash available will give a real estate investor an advantage over other purchasers. The bank loan process generally cannot move that fast! Instead, the real estate investor would go to the private money lender to quickly secure funds to purchase and possibly repair the property. Through advertising, private money lenders can quickly generate a long list of real estate investors who want recurring access to private bridge funding.

Once the real estate investor has purchased and rehabbed the property, it can either be sold for a profit or refinanced for long-term rental income. (Incidentally, in both situations, property sale or property refinance, the private money lender holds the first lien mortgage on the property and is generally repaid first.) Without funding from the private money lender, that investor would have missed out on an excellent opportunity for profit. Real estate investors continuously seek to find and build relationships with private money lenders.

As demonstrated in this example, borrowers often try to go to lending institutions or banks for loans. These lending institutions are governed by strict rules and regulations, which present tremendous obstacles for many potential borrowers. Challenging situations such as having less-than-optimal credit scores, insufficient cash flow, or lack of operational history often prevent banks from lending to borrowers. Additionally, there are times when real estate investors, business owners, and entrepreneurs have urgent funding needs, and they cannot wait for a lengthy approval process. We, private money lenders, feel each of these circumstances is unfortunate for borrowers. Still, we also recognize a perfect opportunity to address their funding needs by providing bridge loans (short-term funding).

Private money lending bridge loans are more flexible and are processed faster than loans from traditional institutions. This solves funding problems and satisfies the needs of many borrowers. Borrowers appreciate having access to financing and prefer the convenience and ease of obtaining loans from a private money lender. Although the private money lender fees and interest charges are higher than those of traditional lending institutions or hard money lending organizations, the benefits of private money bridge financing outweigh the borrowers’ loan costs. As a result, borrowers are willing to pay a premium for bridge funding and related services.

While the borrower realizes that private funding comes at a higher price than loans obtained by traditional lending avenues, he or she often perceives such additional expense as far less than the loss of potential profits from NOT having the funding to take advantage of business opportunities.

Case in point, many times a business owner must give up equity ownership of their company in order to secure capital for a business endeavor or rescue. This can be very costly for the business and for the one who owns the establishment. In most cases, the business owner would prefer not to dilute or reduce their equity ownership because, with time, the equity of successful businesses usually increases. Rather than selling the equity to gain necessary funds, the business owner would prefer to borrow from a private money lender. Without diluting the equity, the business owner has both preserved the future value of the business and likely has secured the funding for an additional enterprise. To reiterate, the private money lender fees and interest charges are higher than those of traditional lending institutions or hard money lending organizations, but the benefits of private money bridge financing far exceed the borrowers’ loan costs.

Of note, while private money lending is not the solution for every borrower’s situation, the borrowers who have the qualified collateral to secure a funding request are overwhelmingly pleased with the process and outcomes. Funding from private money lenders provides immeasurable success and benefits for the borrower, and time and time again, lives are financially impacted in a positive way from access to private funding. It is not unheard of to have experiences with borrowers, similar to scenes from TV shows such as Shark Tank, where borrowers shed tears of relief and gratitude when someone believes in them and can provide a funding solution! This is a rewarding experience for both the borrower and the private money lender.

Some of these borrower benefits and successes include the following:

(1) Real Estate Funding

Private money lenders help numerous real estate investors purchase, fix, and flip properties for a profit, and can be used for new home construction. Other times, real estate funding is used when there is a default on a bank loan or delinquency in property taxes. In these cases, the funding helps stop foreclosure actions that result in the sale of personal property.

(2) Business Funding

Private money lenders assist businesses in multiple ways. A private money lender might subsidize a start-up, purchase an existing business, support a business rescue, or fund a business expansion. Through private money loans, business owners can acquire additional operating capital, inventory, accounts receivable, advertisements, new hires, new partnerships, or other necessities for expansion. With money secured from private lending, business owners may pay existing lenders, recapitalize the business for sustainable growth, fund additional revenue streams to achieve profitability, or be creative with another financial solution for turnaround.

In each of the above business funding categories (start-ups, expansion, and rescue), real estate is generally used as the preferred collateral type to secure a bridge loan funding arrangement.

Private money lending changes the lives of both borrowers and the private money lender. Rewards are both financial and personal. Private money lending provides a true win-win situation!

“This book and educational training course is our gift to the world. Our desired legacy is to improve the lives of others by growing their financial net worth,” PML Creating Wealth Private Money Lenders/Investors

Comparison of Business Opportunities and Benefits

Private money lending with adequate collateral is considered a sound financial investment and can prove to be a lucrative business, especially in comparison with other business opportunities. Let’s look at two of the most popular traditional business endeavors and how they compare with private money lending: (1) real estate investing, fix and flips; and (2) the purchase of a business and or franchise.

Photo by Michael Tuszynski on Unsplash

Comparison Opportunity – The Real Estate Investor – Fix and Flips

Many real estate investors fix and flip properties for profit. The majority of these real estate investors (flippers) do not typically earn the same consistent high rate of return that private money lenders generate. First and foremost, real estate flipping is a very competitive marketplace. It’s like a school of fish competing for a few breadcrumbs. Because a significant number of real estate buyers vie for investment purchases in a competitive real estate marketplace, prices of properties are driven up. Increased investment costs for real estate purchases, coupled with increased rehab expenses, holding costs, and sales fees have decreased net profits from real estate flips, turning many of these purchases into real estate flops. In addition, upon the end sale of the property, the real estate investors must first pay the mortgage lender, realtor, attorney, a title company, and others before reaping their return on investment (ROI). On the contrary, when a private money lender is the primary funding source, the private money lender holds the first mortgage and is generally the first to be paid when the property is sold or refinanced. This translates to less investment risk. Essentially, real estate flippers incur numerous expenses and a great deal of time investment. The result is often a minimal net profit or no profit at all, a large financial investment, and a lot of toil and sweat.

The private money lender, on the other hand, charges higher rates than institutional lenders. Because of that, the fees and interest rates can easily generate up to 35% or more annual rate of return on investment (ROI).

When structured correctly, even the worst-case scenarios can produce a 35% forecasted annualized rate of return on investment (ROI). By lending only up to 50%, or less of the collateral cost, transactional failure is improbable; however, even failures often present interesting private money lender opportunities.

As you can imagine, unlike private money lenders, most real estate investors don’t see consistently high ROIs. Also, the real estate investor’s risk is dramatically higher than that of a private money lender. Even a private money lending transactional failure could lead to some opportunities to purchase real estate properties at deeply discounted prices. Purchasing real estate opportunities at deep discounts will be addressed later in the book.

A small investment can be the impetus to significant wealth as private money lending yields higher rates of returns (ROI) than most other business or investment opportunities. Reinvesting your profits with compounded interest enables the private money lender to create wealth and lead to financial independence (refer back to figures 1 and 2)

Comparison Opportunity – The Purchase of a Business and/or Franchise

Comparison Opportunity – The Purchase of a Business and/or Franchise

Like real estate, business profits must be shared and parried, and the business owners do not get to keep all the profits. Starting a new business is challenging and requires a sizeable monetary capital investment. It is virtually impossible to begin a business venture without enough financial backing to reach a point of sustainability. A business purchase, private or franchised, usually requires large initial monetary capital investments. Those investments are often not recouped if there is a business failure, bankruptcy, or other hardship that requires the liquidation sale of the business and assets. That is simply not true for the private money lender, who most often needs less investment to provide a bridge loan. When the loan is structured correctly, funding will be secured with an asset (collateral) worth approximately twice the loan amount’s value.

Blogger John Boitnott summarizes common business risks and lists them in the following seven categories:

- Economic risk – market fluctuations

- Compliance risk – rules and regulations

- Security and fraud risk – liability for data breaches or fraud

- Financial risk – business suffers financially

- Reputation risk – poor Yelp and Google reviews

- Operational risk – unexpected events that interfere with business, for example, Covid-19

- Competition risk – additional companies in the same market area (American Express, 2019)

It is common to hear and see a business person invest significant time and money just to have the business fail. Statistically, more than half of new

businesses fail. Data from the Bureau of Labor  Statistics (BLS), February 28, 2020, shows that approximately 20% of new businesses fail during the first two years of being open, 45% during the first five years, and 65% during the first ten years. Only 25% of new businesses make it to fifteen years or more.

Statistics (BLS), February 28, 2020, shows that approximately 20% of new businesses fail during the first two years of being open, 45% during the first five years, and 65% during the first ten years. Only 25% of new businesses make it to fifteen years or more.

The hard-earned business financial investment often results in a loss from a business closure, bankruptcy, or other hardship that requires the business’s liquidation sale. What’s left? More expenses and headaches!

https://www.stakeholdermap.com/risk/business-risk.html

https://www.stakeholdermap.com/risk/business-risk.html

Again, the risk is low for the private money lender, as s/he lends only to borrowers who have collateral worth approximately twice the market value (based on cost) of the given initial loan amount. It almost goes without saying that private money lenders also have less hassle and management tasks than business owners. Owning a business requires ongoing financial management and business responsibilities. In addition to the previously mentioned risk factors, a business owner must control costs for inventory, advertising, and other operating expenses. He or she must also manage to stay compliant with government regulations, supervise employees, resolve customer satisfaction issues, and deal with increased competition. The managerial challenges of day-to-day business problems and high overhead expenses cause frustration for the business owner, while that business owner is merely trying to eke out a profit. There is a much better way!

On the other hand, the private money lender can work from anywhere they choose and employ few if any, employees. Operational overhead for private money lenders is considerably less complicated and less expensive than that of many business owners. Best of all, private money lending can be done more efficiently than real estate flipping or running a day-to-day business. Because of this, the private money lender can choose to work a few hours each week, or he/she can do it as a full-time profession. Lending privately can also provide a fantastic passive income. Time commitment and flexibility are private money lending luxuries that real estate flippers and business owners cannot afford when trying to achieve profitability.

Conclusion: Private money lenders have fewer financial risks, initial less investment, higher rates of returns (ROI), positive monthly cash flow, fewer business burdens, and greater consistent net rate of returns than most small businesses, franchises, and real estate investors who fix and flip real estate. Collateral with significant equity and value mitigates financial risks, thus improving risk tolerance. Also, having fewer business expenses, employees, and government regulations translates into a more advantageous business opportunity when compared to other business or franchise investments currently available in today’s challenging financial climate.

Most importantly… The overall process is relatively simple, and over time, compounding profits can generate significant wealth and financial independence (refer to figures 1 and 2).